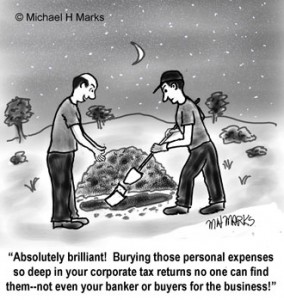

Small business owners add personal expenses into business expenses to show less income and hence pay less taxes. Minimizing tax liability is a strategy all business owners think about. But when it is time to obtain financing or sell the business, buried personal expenses and assets can create a problem in determining the true cash flow. When showing cash flow, we as advisors, usually adjust the cash-flow by adding non-business expenses to the bottom line – these are commonly referred to as add-backs. Some of the add-backs are easy to show or defend – e.g. salaries and benefits paid to a non-working family member, or owner’s retirement savings, or even a personal car paid for and maintained by the Company. Others are more difficult to defend. For example some of the personal expenses charged on company credit card, gifts for family members bought on company expense, personal travel mixed in with business travel, and the list goes on.

The problem is that the buyers and bankers won’t always give credit to many of these items. As a result, the cash flow can be suspect. And when you apply a multiplier to determine the value of the business, the results can be disappointing. For example, many small businesses (say up to about $10 million or so, typically sell at multiples of about 2.5-4 of adjusted EBITDA. So if you tried to shield say $100K of profit by putting personal expenses on the company account, you may lose up to $400K of valuation on your Company.

Even worse is when one does not even report some of the income on the books. This seems to be more common in certain main street businesses where cash transaction is common. One of the businesses which we were trying to sell had a cash component to it (selling parts). The owner’s Tax Returns showed an annual income of about $600K. However, he swears that his real income (and cash flow) is at least $100-150K higher. Problem is how can you prove it? And who will believe it? Had he reported his true income. the business would have been very attractive, it would have found ready buyers and bank would have been willing to finance it. As it turns out, banks are not willing to finance it at the price he is looking for, and the business is not attractive to the buyers (and hence has not sold).

So, it is in the best interest of a business owner to show a healthy bottom line in the years preceding the sale of their business to get the highest price possible, and make it attractive for buyers and lenders.