Whereas most of you might have had experience selling your home, you may not have had an experience in selling a business.

Whether you are selling a home or your business, your goals are the same: Sell it quickly and get the best price. To do this, in the case of your home, typically you want to clean up the home, remove all clutter, fix up things that are broken, and stage it to look attractive.

In some ways, selling a business involves similar things – fix areas that may need fixing, keep clean books and easy to understand financials, and make sure that the business runs smoothly and your place of business looks attractive and presentable.

But in contrast to selling a home, making a business sellable and being able to get top dollars, often can take a year or several years of preparation. The best strategy is to run the business so that it can be easily sold even if you are not planning to sell it. This will only make your business stronger and more profitable, easier to run, and if it becomes necessary for you to sell your business, you are prepared.

So what makes your business attractive to buyers? What we see from our experience is that the buyers are in general looking for following qualities:

- Healthy Business. Most of the buyers are looking for a business that is healthy, making money, and can provide for good income for them. Exceptions are start-up businesses which have good potential for a strategic buyer, or someone who loves a challenge of turning a business around and is looking to buy such a business for cheap. (Somewhat similar to home buyers who are looking for move-in ready homes versus fixer-uppers). Most of the time, we find that it is very hard to find buyers who want to buy a business making little or no money. The value of the business also improves significantly if it generates healthy profits.

- Business is on Auto-Pilot. Which means that there is an excellent management team in place, with good processes and standard operating procedures. It requires very little input of the owner in day to day running of the business. This also increases the value of the business significantly because the buyer does not have to bring in expensive management team.

- “Sticky” Customers. Customers are heart and soul of the business and nothing pleases a buyer more than to see that these customers are ‘sticky’ and ideally are tied to the business via long-term contracts, providing consistent revenues every year. Getting new customers is not easy – one of the main reason people buy a business rather than starting from scratch. Sticky customers will improve the value of your business.

- Diversified Customer Base. Buying a business where a high percentage of business is dependent on a few customers is risky for the buyer. If that customer leaves, the business will suffer. Ideally, no single customer should be responsible for more than 5-10% of the revenue, unless that customer does have a long-term contract.

- Happy and Competent Employees and Management Team. If the employees have a high morale and management team is doing a great job, the transition to the new owner becomes seamless.

- No Legal Issues. No one wants this headache.

- Clean Financials. Buyers don’t like “fuzzy” financials and mingling of personal and business expenses. Keep your books clean. Whereas some personal finances are easier to explain (e.g. certain management perks such as car allowances, Life insurance payments), others cannot be and you will unnecessarily create distrust for the buyer. You maybe save some on taxes, but lose out on the value and attractiveness of your company.

- Keep it Lean and Trim. Always try and curtail unnecessary or extravagant expenses and keep your margins high. This does not mean paying too little to your employees or not giving them good benefits (these are short term savings that does not help you long-term), but it does mean investing in tools and processes that help you run your business efficiently, improving productivity, focusing on the profitable segments of your business and cutting down on frivolous expenses.

- Stand-out from your Competition. Buyers would love a business that is somewhat different. This could be due to some unique technology or product, could be from particular branding, or could be from niche business focus. A stand-out business would attract strategic buyers and almost certainly bring you good value.

- Business Reputation. Finally, does your business enjoy a good reputaion in the marketplace? Are your customers happy or fanatic about your service? Are employees talking good things about your company? Is there any regulatory or legal trouble? Buyers would love such businesses.

Knowing what most buyers are looking for will help you make your company more attractive to buyers and also will help you get top dollar for your business.

You can also read an excellent book by John Warrillow, called Built To Sell. He also runs very interesting podcasts on the subject. Another great book, that emphasizes “Work on your business and not in your business”, called E-Myth Revisited by Michael Gerber is also a classic, that is a great read, and will help you run the business smoother and in turn make is more sellable.

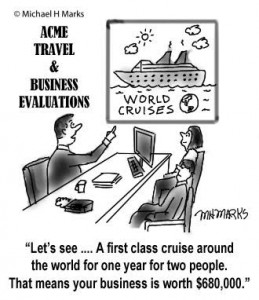

Coming up next … How much is my business worth?

So Long Friends,

Yatin